plowunited.net – The US Commerce Department confirmed that TSMC and Micron will not have to give up equity in exchange for CHIPS Act subsidies. This announcement eased widespread concerns about the government demanding ownership stakes across all semiconductor companies receiving funding. Officials clarified that the Trump administration’s equity-for-funding approach is not a one-size-fits-all policy. Instead, it depends on each company’s actions and level of US investment.

Read More : Lava Probuds Aria 911 Debuts With ENC, 10mm Drivers

Commerce Secretary Howard Lutnick explained during a CNBC interview that the White House seeks a roughly 10 percent equity stake in Intel. This stake relates to nearly $8 billion in CHIPS Act funding, including $3.2 billion from the Secure Enclave program. This program targets the production of secure chips for military and critical government systems. Lutnick emphasized that this equity approach ensures taxpayers receive returns rather than just handing out grants. However, the administration will not apply the same equity requirement to companies like TSMC and Micron, which have increased US investments significantly.

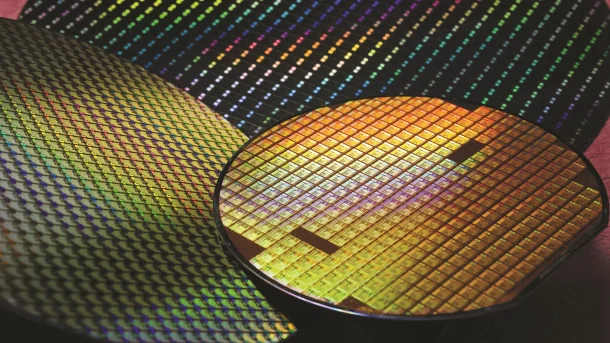

Reports also indicated that TSMC executives considered returning subsidies if forced to divest shares. TSMC received $6.6 billion for its Arizona plant, which began producing advanced chips in late 2024. Yet, the company has not heavily relied on US support and has boosted its investment in the US to $165 billion. Similarly, Micron, which secured $6 billion in subsidies, announced a $200 billion investment plan and a new US factory scheduled to open in 2027. Officials reassured that these companies are exempt from the equity-for-grants policy, easing tensions and providing clarity on government expectations.

Strategic Balance Between Support and Control in Semiconductor Policy

The Commerce Department’s nuanced stance highlights a balance between providing financial support and maintaining government oversight. While Intel faces potential equity conversion tied to its funding, other major players like TSMC and Micron will not be subject to the same requirements. This approach acknowledges the significant commitments these companies have made to expanding US manufacturing capacity.

This policy fits within a broader US strategy to strengthen domestic semiconductor production. President Donald Trump imposed a 100 percent tariff on imported semiconductors but exempted companies manufacturing chips domestically. Furthermore, the administration takes a 15 percent revenue share from China sales of Nvidia and AMD products, reflecting efforts to control technology exports strategically.

However, converting parts of Intel’s CHIPS package into equity may face legal challenges. Previous agreements included profit-sharing provisions and claw-back clauses, complicating the process. Despite this, the government’s position aims to maximize public returns while encouraging substantial investment in US facilities.

Read More : Steam Language Filters May Affect Japanese Game Reviews

In conclusion, the Commerce Department’s updated guidance clarifies that equity stakes will not be broadly demanded from all CHIPS Act recipients. Instead, the administration tailors requirements based on investment and strategic importance. This measured approach seeks to foster semiconductor growth domestically while balancing taxpayer interests and national security concerns. The policy evolution signals continued US commitment to maintaining a competitive edge in the global chip market.